Carrier vs Broker: What's the Difference?

Table of Contents

- What Is an Auto Transport Carrier?

- What Is an Auto Transport Broker?

- How Do Carriers Operate in Vehicle Shipping?

- How Do Brokers Function in the Car Shipping Industry?

- What Are the Legal Requirements for Carriers and Brokers?

- What Insurance Coverage Do Carriers and Brokers Provide?

- How Does Pricing Differ Between Carriers and Brokers?

- Which Option Provides Better Customer Support?

- How Can You Verify Legitimacy?

- Carrier vs Broker: Final Analysis

What Is an Auto Transport Carrier?

An auto transport carrier is a trucking company that physically transports vehicles using its own fleet-owned trucks and equipment. Asset-based carriers employ owner-operator drivers or company drivers who operate auto transport trucks equipped with multi-car trailers or single-car trailers. These vehicle shipping companies handle complete logistics services from vehicle pickup and delivery to final destination.

Carriers maintain direct control over freight transportation operations. The car hauler executes route optimization, load scheduling, and maintains carrier availability through internal dispatch systems. Asset-based carriers invest capital in purchasing and maintaining fleets, hiring qualified drivers, and securing commercial parking facilities.

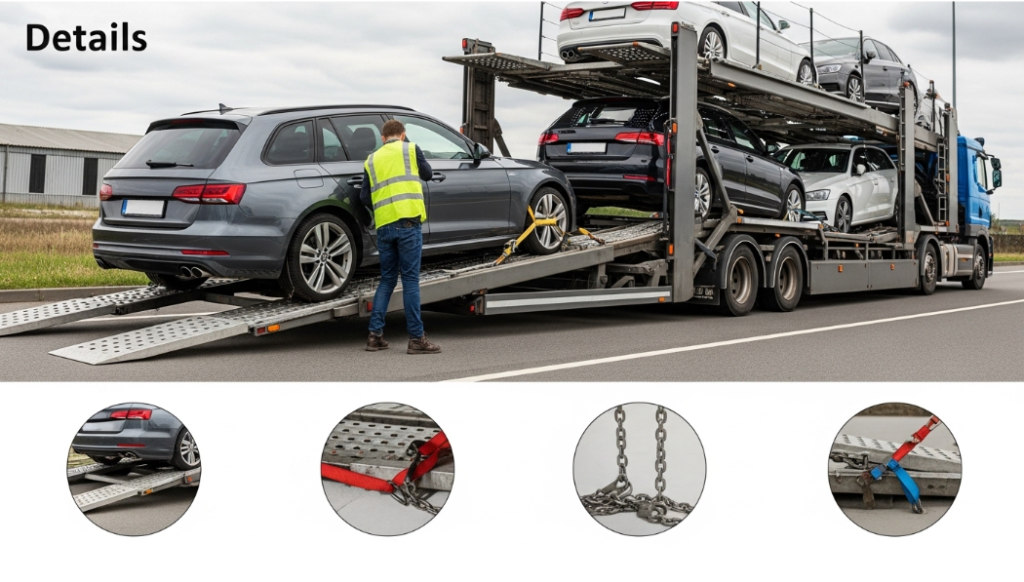

The vehicle transportation network operated by carriers includes both open car carrier and enclosed car carrier options. Open carriers transport 7-10 vehicles simultaneously on exposed multi-car trailers. Enclosed carriers protect luxury or classic automobiles inside covered trailers during interstate auto transport operations.

Carriers conduct pre-transport inspection and post-delivery inspection procedures. The vehicle inspection report documents existing damage before transportation begins. The bill of lading (BOL) serves as a legal contract between the carrier and vehicle owner, establishing liability parameters.

What Is an Auto Transport Broker?

An auto transport broker is a shipping intermediary that connects vehicle owners with qualified carriers without owning transportation equipment. Logistics brokers maintain extensive carrier networks through digital load boards and relationship management. These freight brokers coordinate shipment logistics but do not physically transport vehicles.

Brokers provide dispatching services by matching customer requirements with appropriate carrier availability. The carrier matching process evaluates 12-15 criteria including route compatibility, equipment type, insurance coverage, and FMCSA safety ratings. Order management systems streamline quote comparison and booking procedures.

Auto transport brokers negotiate transportation rates with multiple carriers through established carrier networks. Price negotiation occurs between brokers and trucking companies based on current market rate fluctuations, seasonal demand, and distance factors. Customer support agents manage communication between vehicle owners and assigned carriers.

Broker fee structures compensate intermediaries for coordination services. Federal transportation regulations require brokers to maintain transparent pricing disclosure. The shipment coordination process includes scheduling, documentation management, and status updates throughout the vehicle shipping timeline.

How Do Carriers Operate in Vehicle Shipping?

Carriers execute door-to-door transport or terminal-to-terminal transport based on customer specifications. Door-to-door shipping delivers vehicles directly from origin address to final destination address. Terminal transport requires customers to drop off and retrieve vehicles at designated carrier facilities.

Carrier Operational Structure

The following table demonstrates carrier operational characteristics:

|

Operational Aspect |

Asset-Based Carrier |

Measurement Unit |

|

Fleet Size |

5-200+ trucks |

Vehicles |

|

Loading Capacity |

7-10 vehicles (open) / 1-6 vehicles (enclosed) |

Units per load |

|

Average Transit Time |

3-7 days (1000 miles) |

Days |

|

Insurance Coverage |

$100,000-$1,000,000 |

USD per incident |

Carriers maintain carrier cargo insurance policies ranging from $100,000 to $1,000,000 per occurrence. Liability insurance protects against damages during loading, transport, and unloading operations. Proof of insurance documentation must accompany every vehicle shipment.

The vehicle inspection report catalogs existing scratches, dents, and mechanical conditions. Photographs document all vehicle surfaces before loading onto the auto transport truck. This documentation establishes baseline conditions for damage claims assessment.

How Do Brokers Function in the Car Shipping Industry?

Brokers operate through centralized load boards such as Central Dispatch, which connects 15,000+ active carriers nationwide. Auto transport brokers access transport management systems (TMS) that aggregate carrier availability, equipment types, and current locations. Digital platforms enable real-time carrier matching based on customer requirements.

The logistics broker evaluates 8-12 carrier profiles before selecting optimal matches. Background checks verify USDOT numbers, MC numbers, insurance validity, and safety records maintained by the Federal Motor Carrier Safety Administration (FMCSA). Verified carrier networks contain pre-screened trucking companies meeting minimum qualification standards.

Automated dispatch systems distribute shipment requests to qualified carriers within specific service areas. GPS vehicle tracking technology provides location updates during transit. Digital bill of lading systems replace paper documentation, improving processing speed and accuracy.

What Are the Legal Requirements for Carriers and Brokers?

Federal transportation regulations administered by FMCSA establish distinct licensing requirements for carriers and brokers. Carriers must obtain carrier authority with a valid MC number and USDOT number. Brokers require separate broker authority with dedicated MC number registration.

Licensing and Compliance Requirements

The following table outlines regulatory requirements:

|

Requirement Type |

Carriers |

Brokers |

Regulatory Body |

|

MC Authority |

MC Number (Carrier) |

MC Number (Broker) |

FMCSA |

|

USDOT Number |

Required |

Required |

FMCSA |

|

Surety Bond |

BMC-85 ($75,000 minimum) |

BMC-84 ($75,000) |

FMCSA |

|

Insurance Minimum |

$750,000-$1,000,000 cargo |

$75,000 bond coverage |

FMCSA |

State transportation laws impose additional registration requirements. Licensing and registration processes vary across 50 states. Broker bond requirements (BMC-84) protect consumers against broker insolvency or fraud. The surety bond guarantees payment to carriers for services rendered. Carrier bonds (BMC-85) ensure financial responsibility for cargo damage claims.

Compliance requirements include maintaining current insurance certificates, filing annual updates, and adhering to hours-of-service regulations for drivers.

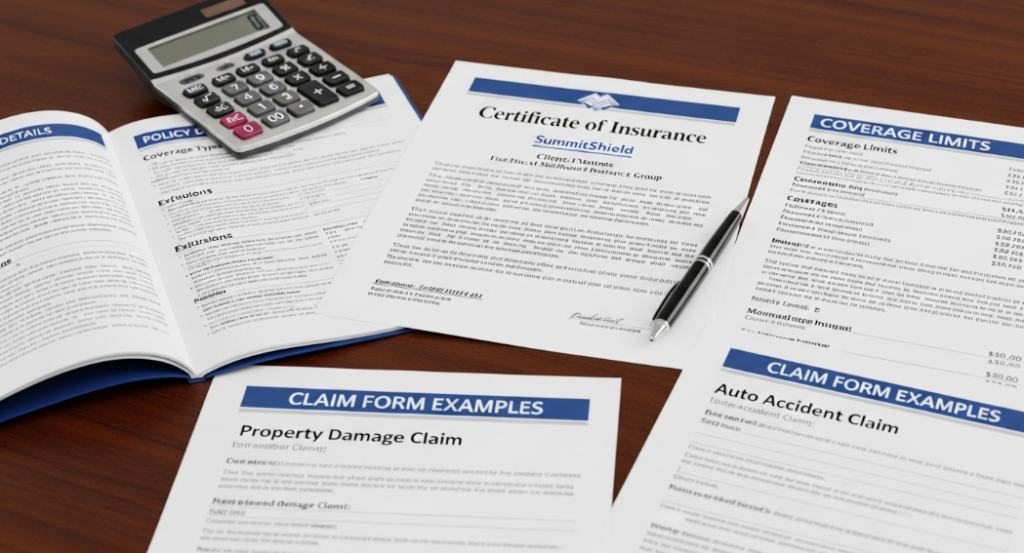

What Insurance Coverage Do Carriers and Brokers Provide?

Carriers maintain comprehensive carrier cargo insurance covering vehicle damage during transport operations. Standard coverage ranges from $100,000 to $1,000,000 per occurrence. Enclosed carriers typically carry higher coverage limits due to transporting high-value vehicles.

Liability insurance protects against third-party property damage and bodily injury. Vehicle transport damage insurance coverage specifically addresses scratches, dents, broken glass, and mechanical failures occurring during loading, transit, or unloading.

The claims process initiates with damage inspection comparing pre-transport and post-delivery vehicle conditions. Photographic evidence from the vehicle inspection report supports claim submissions. Insurance carriers typically respond to claims within 30-45 days.

Broker bond coverage differs fundamentally from carrier insurance. The BMC-84 broker bond protects against broker fraud, not vehicle damage during transport. Brokers do not carry cargo insurance because they do not physically transport vehicles. The contracted carrier’s insurance covers transportation-related damages.

However, if any kind of damage occurs during transit, the broker facilitates the claim process and ensures the loss is covered through the contracted carrier’s insurance coverage.

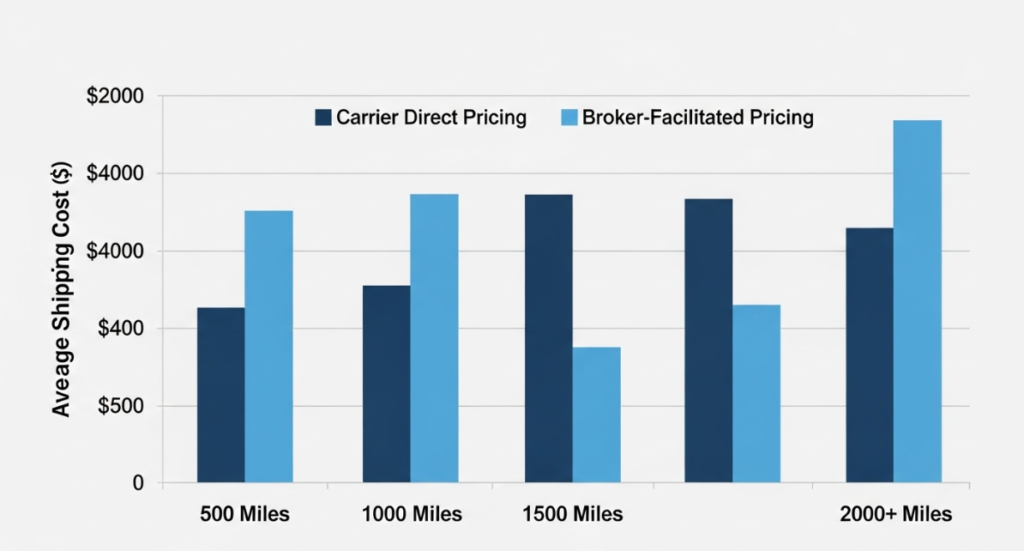

How Does Pricing Differ Between Carriers and Brokers?

Auto transport quotes vary based on 7 key factors: distance, vehicle size and weight, transport method selection, pickup and drop-off locations, seasonal demand, carrier availability, and fuel costs. Market rate fluctuations respond to supply-demand dynamics in the freight transportation industry.

Working directly with asset-based carriers eliminates broker fees ranging from 15-30% of total shipment costs. Carriers quote flat rates covering all transportation expenses. Brokers aggregate quotes from multiple carriers, potentially identifying lower-cost options. Quote comparison services evaluate 5-10 carrier proposals.

Distance and route factors significantly impact pricing. Cross-country car shipping from California to New York costs $1,100-$1,400 for standard open transport. Long-distance vehicle shipping exceeding 2,000 miles requires 7-10 days transit time.

Seasonal demand peaks during summer months and snowbird migration periods (October-November, April-May). Carrier availability decreases during high-demand seasons. Expedited auto transport services cost 30-50% more than standard auto transport timelines.

Which Option Provides Better Customer Support?

Carriers offer direct communication with drivers and dispatch personnel managing shipments. Customer support agents employed by carriers access real-time operational data. Response times average 2-4 hours during business operations.

Brokers dedicate customer support teams managing communication between clients and contracted carriers. Order management systems track shipment status through automated updates. Customer support agents resolve issues by coordinating with carrier dispatch teams.

Timeline reliability varies by operational model. Carriers control scheduling directly through fleet management. Brokers coordinate backup carriers when original assignments fail. Service agreements outline service level expectations, cancellation policies, and dispute resolution procedures.

BBB accreditation indicates commitment to ethical business practices. Online reputation reflects customer satisfaction across 10+ review platforms.

How Can You Verify Legitimacy?

Scam prevention requires verification of 6 critical credentials: USDOT number, MC number, insurance certificates, physical business address, customer reviews, and operating history. The FMCSA database allows public verification of carrier authority and broker authority registration.

Verification Checklist

Industry best practices recommend the following verification steps:

- Search USDOT and MC numbers through FMCSA Safer System database

- Verify insurance coverage by contacting insurance providers directly

- Check BBB accreditation status and complaint history

- Review customer testimonials on independent platforms

- Confirm physical business address through satellite imagery

- Verify operating history exceeding 12 months

- Avoid companies requiring deposits exceeding 25% of total cost

Background checks reveal safety records, insurance claims history, and complaint patterns. Verified carrier networks maintained by AWZ AutoTransport include only carriers meeting stringent qualification standards.

Service transparency requires clear communication about shipment timelines, carrier assignment, and pricing breakdowns. Pricing transparency mandates itemized quotes separating base transportation costs from optional services and broker fees.

Carrier vs Broker: Final Analysis

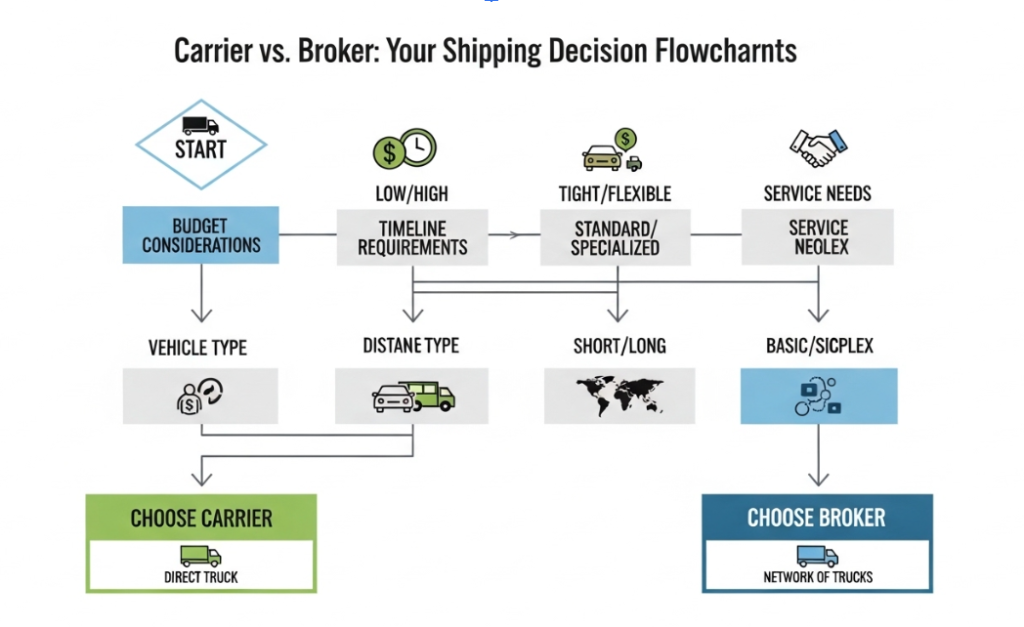

Yes, choosing between carriers and brokers depends on specific shipping needs, budget constraints, and service priorities. Direct carrier booking suits customers prioritizing cost control and direct communication. Broker services benefit customers requiring specialized services or competitive pricing through multiple quotes.

Decision-Making Framework

Carrier Advantages:

- Direct communication with transportation provider

- Potentially lower costs without broker fees

- Single point of accountability

- Immediate driver contact during transit

Carrier Limitations:

- Limited service area coverage

- Reduced equipment variety

- Potential capacity constraints during peak seasons

Broker Advantages:

- Access to extensive carrier networks spanning 48 states

- Competitive pricing through quote comparison

- Specialized service coordination including military vehicle shipping, auction vehicle transport, and dealer-to-dealer transport

- Backup carrier availability

Broker Limitations:

- Broker fees increasing total costs by 15-30%

- Indirect communication with actual transportation provider

- Multiple parties involved in service delivery

AWZ Auto Transport operates as a licensed auto transport broker providing comprehensive vehicle shipping services across all 50 states. Our verified carrier network includes 500+ qualified carriers maintaining FMCSA compliance, appropriate insurance coverage, and proven safety records.

Timeline reliability averages 95% for standard auto transport bookings through AWZ AutoTransport. The car shipping industry continues evolving through technology integration, improved regulatory oversight, and enhanced customer protection measures. Understanding fundamental differences between carriers and brokers empowers informed decision-making aligned with individual transportation requirements.